Digital Revolution and Route-to-Market Strategies Will Drive African Growth

Source : Euromonitor

A developing economic environment

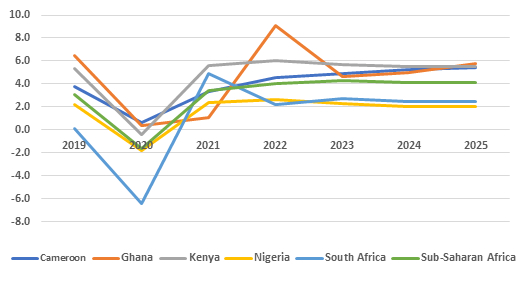

There has been steady growth in Africa over the past few years, and the average annual real GDP growth for sub-Saharan Africa is expected to be 4% in 2025, with countries such as Ghana, Kenya and Cameroon reaching 6%. Growth is being accompanied by a trend towards urbanisation, which is also seeing a rise in modern retailing, with the building of supermarkets and hypermarkets in major cities throughout Africa – although traditional and informal markets remain important.

Average Annual Real GDP Growth %

2019 to 2025: Selected African Countries

Source: Euromonitor International

Source: Euromonitor International

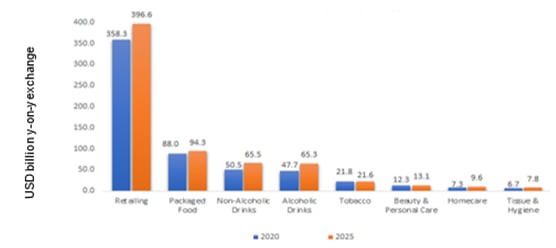

The continent has also witnessed an increase in the middle class, and Africa is set to show strong growth in disposable incomes to 2030, with a 4% CAGR, according to Euromonitor International data. This will be illustrated by a rise in sales in key African countries over the forecast period in industries such as packaged food, non-alcoholic drinks and alcoholic drinks, to name a few.

Top Industries by Value in 2020/2025 for Selected African Countries*

*Algeria, Angola, Cameroon, Egypt, Ethiopia, Ghana, Côte d’Ivoire, Kenya, Morocco, Nigeria, South Africa, Tanzania, Tunisia, Uganda

Source: Euromonitor International

At a government level, there also is momentum to meet the continent’s logistic, economic and food security challenges. The African Free Trade Continent Agreement, which came into effect in January 2021, is allowing for easier trade on the continent by reducing tariffs among member countries and standardising policies on trade.

Digital connectivity driving the way forward

However, things are changing on a larger scale, and this is due to the digital revolution – from smartphones to mobile payments to knowledge sharing – which is enabling more targeted and innovative responses to meet the demands the continent faces, turning challenges into opportunities.

Mobile subscriptions have increased across the continent and are set to soar by 2030, reaching nearly 1.4 billion subscribers. This connectivity provides a lifeline for many Africans. For example, many do not have a bank account, so this allows users to deposit money into an account stored on their mobile phone and to send balances to a seller or service provider through a secure system. This enables lower-income consumers to purchase necessities, whether through mobile wallets, or other financial platforms, such as micro credit or leasing.

Not tied to the legacies of the past, the continent is providing a testing ground for digital innovation, allowing individuals and companies to better utilise existing resources. One example is the use of apps that provide farmers with commodity pricing or equipment training. From this perspective, what one quickly notices is that opportunities abound across the region for those willing to understand the complexities of doing business in Africa. Social media also makes it easier to target and connect with these consumers, as well as to develop partnerships with people on the ground.

Localising route-to-market strategies

As important as digital technologies are route-to-market strategies that recognise the continent’s difference from developed continents. Africa comprises 54 independent countries, each having their own cultural attitudes and beliefs. In other words, one size does not fit all. Thus, when selling products in African markets, it is best to keep branding messages local in order to respect cultural nuances. Key recommendations include:

- Connecting to informal markets: These local and less formal establishments reflect where many Africans shop, including more affluent consumers, who see informal markets as part of their cultural heritage. Developing an informal retail strategy is just as critical as developing a modern retail one, although affordability drives both.

- Creating local partnerships throughout the supply chain: Locals understand what works and what does not. This can assist businesses in overcoming distribution challenges, including delivering to hard-to-reach places. Getting their advice and keeping conversations current will allow companies to be more flexible in addressing changing market needs and provide a greater stake in the outcome.

- Promoting social trust: Communication solutions need to be established that promote social trust, including the importance of local communities in delivering messages. Word of mouth takes prominence, with good news travelling fast due to the strong trust in advice from peers, which can become strong social currency. Finding these “social” arenas and creating an authentic message will create a positive consumer response.

It is fair to say that opportunities abound in Africa for those willing to understand the complexities of doing business there. With the rise of digital technology, which allows companies to penetrate a wider consumer base, and more localised route-to-market strategies, companies can ultimately succeed. Nevertheless, developing a long term strategy, which allows time for ideas to resonate and structures to be put in place, will have the best pay-off over the medium to long term.