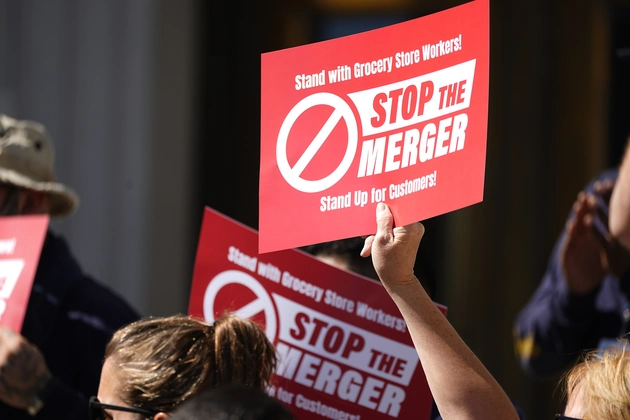

This time last year, the highly publicised merger attempt between Kroger and Albertsons dominated headlines across the United States. The Federal Trade Commission (FTC) eventually stepped in, blocking the deal on grounds of consumer protection and competition fairness. The decision was hailed as a landmark ruling — a move that prevented what could have become the largest supermarket consolidation in American retail history.

However, as the dust settles, industry insiders are predicting a new chapter in supermarket partnerships — one that will look markedly different from the Kroger-Albertsons model. While last year’s plan centred around corporate unification, the next wave of collaboration among retail giants will focus on strategic alliances and collective buying power, designed to achieve the same efficiencies without triggering regulatory red flags.

A Shift from Merger to Alliance

Two major supermarket chains — whose names have not yet been formally disclosed but are believed to operate across both the Midwest and East Coast — are in early-stage talks to form a purchasing partnership, according to sources close to the negotiations.

Unlike the Kroger-Albertsons proposal, this plan would not involve a full merger or shared ownership. Instead, it would unify their procurement divisions, allowing both retailers to negotiate stronger terms with suppliers, cut distribution costs, and streamline product sourcing on a national scale.

The aim is clear: strengthen competitiveness against retail behemoths such as Walmart, Costco, and Amazon Fresh, which continue to dominate market share through volume-based economies and aggressive pricing strategies.

The Rise of Unified Buying Power

Under the proposed alliance, the two retailers would create a joint procurement hub, handling core categories such as grocery essentials, household goods, private-label products, and fresh produce.

By combining their buying operations, the retailers could achieve price reductions of up to 8–10% across high-volume categories, savings that could be passed down to consumers — or reinvested in digital and logistics development.

“Where Kroger and Albertsons failed was in structure,” one analyst said. “They tried to merge everything — logistics, stores, management — and that triggered antitrust scrutiny. This new model focuses only on collective negotiation, not market dominance. It’s a smarter, leaner approach.”

A Regulatory-Friendly Blueprint

The FTC’s 2025 decision sent a clear message: massive mergers that risk creating regional monopolies will not pass. However, joint ventures and buying alliances remain viable pathways for growth.

European markets, particularly in France, Germany, and the UK, have already adopted similar models. Retail groups such as Carrefour, Tesco, and E.Leclerc have long engaged in collective purchasing partnerships to gain leverage over multinational suppliers like Nestlé, Unilever, and Procter & Gamble — all without breaching competition law.

This “European blueprint” now appears to be influencing American strategy.

Technology and Data at the Core

What distinguishes the upcoming alliance is its potential use of AI-driven purchasing systems and real-time supplier data integration. By analysing sales patterns, inventory fluctuations, and logistics costs across both networks, the combined system could make smarter, faster procurement decisions.

“This is not a merger of stores; it’s a merger of intelligence,” one insider commented. “They’ll act as two companies with one brain when it comes to buying.”

Consumer Impact: Lower Prices, Greater Choice

For consumers, the outcome could be positive. Unified buying power could stabilise prices on key goods and expand private-label ranges — areas where Kroger and Albertsons have both excelled individually.

Retail experts predict that within a year of implementation, shoppers could see price drops of 5–7% on household staples and improved product availability, especially in fresh food categories where shortages and price volatility have become common.

Industry Reaction

The retail world is watching closely. Some see this as a clever workaround — an “unofficial merger” in spirit if not in structure. Others believe it marks a necessary evolution in how supermarkets must operate to remain viable in an age of inflation, e-commerce, and supply-chain complexity.

“There’s no doubt that consolidation — in some form — is the future,” said Phil Lempert, food industry analyst and editor of SupermarketGuru. “But the lesson from Kroger and Albertsons is that it has to be done differently. Collaboration, not domination, is the key.”

Conclusion: The Future of Supermarket Cooperation

The Kroger-Albertsons failure was not the end of consolidation — it was merely the end of an outdated model. The supermarket industry is adapting, moving toward a shared ecosystem of scale rather than single corporate ownership.

If the new alliance succeeds, it may redefine how America’s largest grocers operate — proving that unity without merger can deliver both competitiveness and compliance.

In the ever-changing retail landscape, the message is clear:

It’s no longer about being the biggest. It’s about being the smartest together.