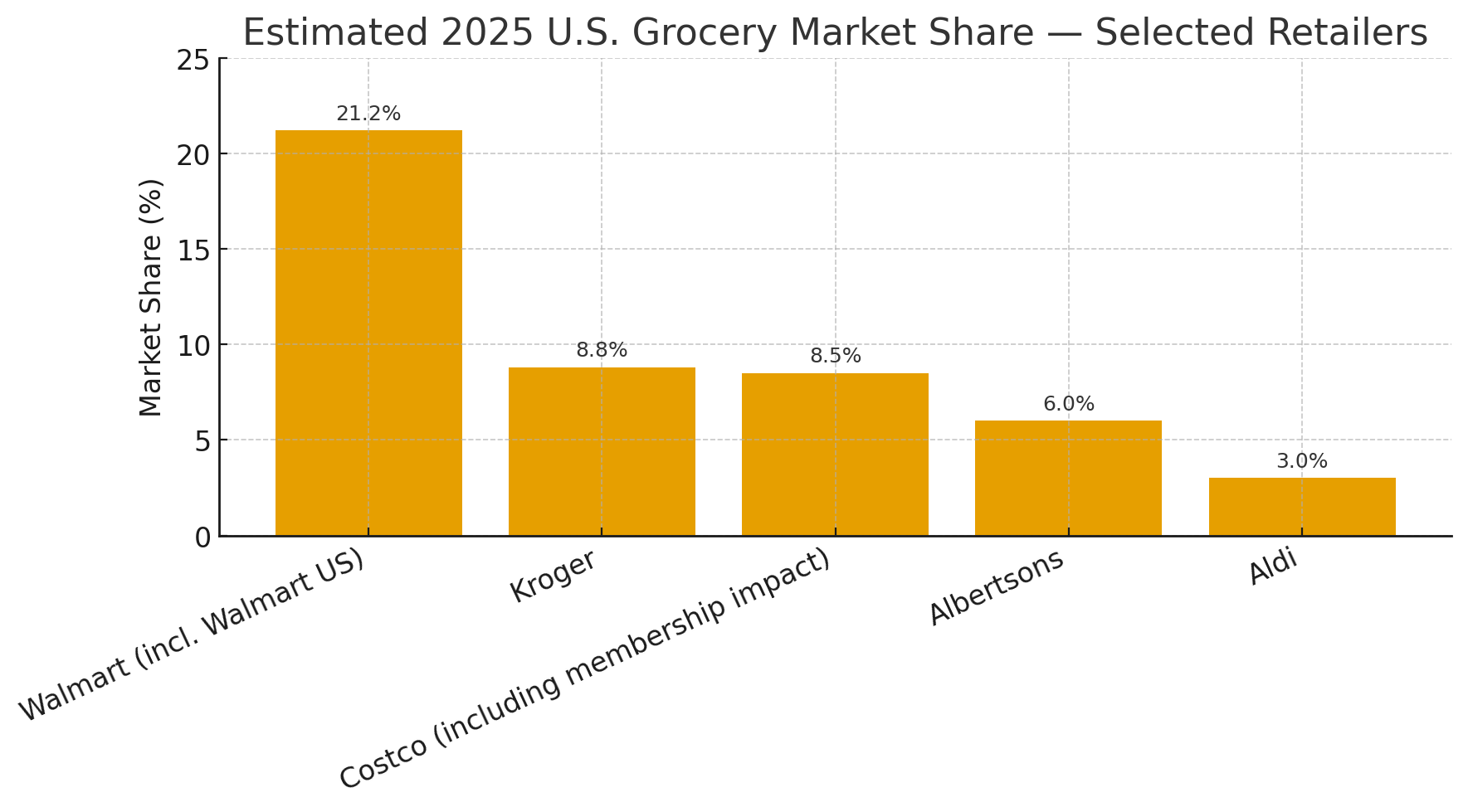

The race for dominance in the U.S. grocery market continues to tighten as major players adjust their strategies to shifting consumer behaviour, inflationary pressure, and technological disruption. According to recent industry estimates, the top five supermarket chains — Walmart, Kroger, Costco, Albertsons, and Aldi — together account for nearly half of America’s grocery spending, reflecting both consolidation and growing competition.

The race for dominance in the U.S. grocery market continues to tighten as major players adjust their strategies to shifting consumer behaviour, inflationary pressure, and technological disruption. According to recent industry estimates, the top five supermarket chains — Walmart, Kroger, Costco, Albertsons, and Aldi — together account for nearly half of America’s grocery spending, reflecting both consolidation and growing competition.

Walmart Leads, but Pressure Builds

Walmart remains the undisputed leader in U.S. grocery retail, commanding an estimated 21.2 percent market share in 2025. The retailer’s dominance stems from its expansive store network, aggressive pricing, and seamless integration between physical and digital platforms.

However, maintaining this lead is becoming increasingly complex. Walmart’s success now depends not only on price competitiveness but also on consumer trust, product transparency, and convenience. Its investments in retail media, delivery logistics, and data-driven personalisation reflect a company preparing for long-term transformation rather than short-term growth.

Kroger and Costco Neck-and-Neck

Kroger holds roughly 8.8 percent of the U.S. grocery market, closely followed by Costco at 8.5 percent. Kroger’s scale and private-label development — particularly the “Simple Truth” and “Private Selection” brands — have helped it retain customer loyalty. Still, its attempted merger with Albertsons, blocked by the FTC, underscores the difficulties of expansion in a tightly scrutinised market.

Costco continues to thrive through its membership model, which encourages bulk purchasing and long-term loyalty. The company’s ability to merge value with premiumisation has proven effective, particularly among middle- to high-income households seeking efficiency and quality.

Albertsons Faces the Next Chapter

At 6 percent market share, Albertsons remains a critical player in regional markets but faces pressure to redefine its identity. The company’s investment in digital platforms and its focus on value-driven assortments have improved its competitiveness, yet the aborted merger with Kroger raises questions about future strategy.

Industry analysts suggest Albertsons could pivot towards smaller acquisitions, technology partnerships, or regional growth, rather than pursuing another large-scale merger.

The Aldi Effect: A Disruptor Gaining Ground

Discount retailer Aldi, with an estimated 3 percent market share, is increasingly punching above its weight. The German discounter continues rapid expansion across the U.S., driven by its efficient supply chain, private-label dominance, and cost leadership.

Aldi’s model — lean assortments, quick shopping experiences, and localised pricing — appeals to inflation-weary Americans. Its acquisition of additional store locations and the opening of new regional distribution centres indicate an ambitious push to challenge mid-tier competitors.

As consumers grow more value-driven, Aldi’s no-frills efficiency may well position it as the surprise winner in the next decade of grocery retail.

A Market in Motion

While Walmart leads in volume and reach, the combined strength of mid-tier retailers continues to reshape the competitive landscape. Inflation and digital transformation have changed what loyalty means: consumers no longer stick with one retailer out of habit but shop where price, convenience, and ethics intersect.

The chart below illustrates estimated 2025 market shares among leading U.S. grocery retailers:

| Retailer | Estimated Market Share (%) |

|---|---|

| Walmart (incl. Walmart U.S.) | 21.2 |

| Kroger | 8.8 |

| Costco (including membership impact) | 8.5 |

| Albertsons | 6.0 |

| Aldi | 3.0 |

(Source: ISN analysis, 2025 estimates based on industry data.)

Outlook: Consolidation or Competition?

After the Federal Trade Commission blocked the Kroger–Albertsons merger, the market has entered a reflective phase. Future consolidation attempts may focus less on footprint and more on digital infrastructure and AI-driven analytics.

Mid-sized regional grocers, along with expanding international entrants such as Lidl, could benefit from consumer fatigue with large-scale mergers. Innovation, local sourcing, and operational agility will define success more than size alone.

ISN View

The U.S. grocery market of 2025 is not merely a battle of price, but a contest of perception and precision. Retailers who understand why Americans buy — not just what they buy — will secure the next wave of growth.

In a country of vast economic diversity and shifting loyalties, success will belong to those who combine value, trust, and digital intelligence into a single, coherent experience.